Federal Law to Protect The Privacy of The American Taxpayer

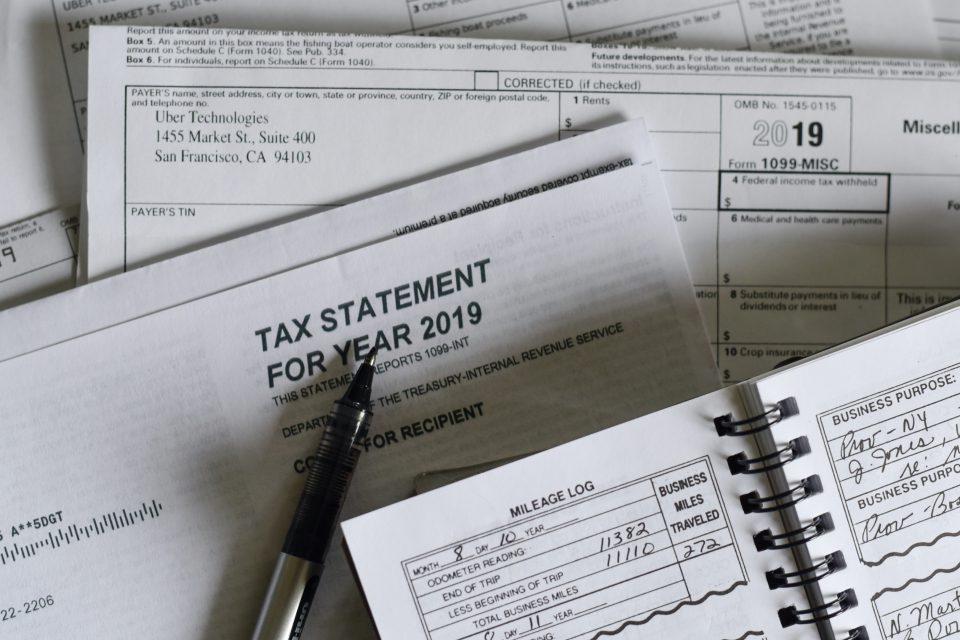

The Taxpayer Browsing Protection Act of 1997 is a federal law that was passed in 1997. The Taxpayer Browsing Protection Act of 1997 was passed in response to reports from the United States General Accounting Office or GAO for short that identified thousands of cases in which employees of the Internal Revenue Service or IRS had accessed the confidential personal information of taxpayers in an unauthorized manner during the mid-1990s. As a result of these troubling findings, Congress passed the Taxpayer Browsing Protection Act of 1997 to provide American citizens with federal protections in the event that their taxpayer information was inappropriately accessed, as well as set forth the punishments that could be imposed in response to this inappropriate access.

Why was the Taxpayer Browsing Protection Act of 1997 needed?

A stated in a report that the GAO made to the U.S. Senate in March of 1999, “Between October 1, 1997, and November 30, 1998, the Office of the Chief Inspector identified 5,468 potential instances of unauthorized access (i.e., “leads”) and completed preliminary investigative work on 4,392 of those leads. Of those 4,392 leads, 338 were determined to warrant further investigation”. What’s more, the report also stated that “In October 1992, Internal Audit reported that the IRS had limited ability to prevent unauthorized accesses and detect such accesses once they had occurred. In September 1993, we reported that the IRS did not adequately monitor the activities of thousands of employees who were authorized to read and change taxpayer files”.

Through the findings of this report, it was revealed to the American public that unauthorized access to American taxpayers’ personal information had been occurring rampantly throughout the 1990s. Moreover, the IRS admitted that they had a limited ability to stop or curtail these instances of unauthorized access, as they had been failing to adequately monitor the activities of their respective employees. Furthermore, of the thousands of incidents in which U.S. taxpayer information was inappropriately accessed, only “one case that was accepted for the prosecution was still open as of February 2, 1999, but the employee has been removed from the agency”. As a result of these invasions of privacy on the part of employees of the IRS, the Taxpayer Browsing Protection Act of 1997 was enacted.

Through the passing of the Taxpayer Browsing Protection Act of 1997, strict regulations were placed on federal employees and individuals who collect and manage the taxpayer information of American citizens. To this end, the law made it unlawful for “any officer or employee of the United States, or person described in section 6103(n) or an officer or employee of any such person, willfully to inspect, except as authorized in this title, any return or return information”. Additionally, the law also placed restrictions on state employees, including “—It shall be unlawful for any person (not described in paragraph (1)) to inspect, except as authorized in this title, any return or return information acquired by such person or another person”.

In response to the passing of the Taxpayer Browsing Protection Act of 1997 and the GAO’s subsequent report, the IRS also took internal steps and measures to help prevent unauthorized access to taxpayer information from occurring in the future. Per the GAO’s report to the U.S. Senate in 1999, “To deal with inconsistencies in case handling and tracking, the IRS created CAU within the Labor Relations Office in the National Office. CAU, which became operational in October 1997, is responsible for tracking and reporting the status of all unauthorized access cases; preparing paperwork for all cases, including those in which unauthorized access was not proven. From October 1, 1997, to January 25, 1999, according to IRS, Internal Security sent CAU 64 cases for adjudication in which unauthorized access was alleged to have taken place after enactment of Public Law 105-35.1”.

What are the penalties for violating the Taxpayer Browsing Protection Act of 1997?

Individuals who are found to be in violation of provisions set forth by the Taxpayer Browsing Protection Act of 1997 are subject to a variety of monetary penalties, as well as criminal liability. More specifically, “Any violation of subsection (a) shall be punishable upon conviction by a fine in any amount not exceeding $1,000, or imprisonment of not more than 1 year, or both, together with the costs of prosecution”. In addition to these punishments, “any officer or employee of the United States who is convicted of any violation” of the Taxpayer Browsing Protection Act of 1997 is also subject to be dismissed or discharged from their office of employment.

As the personal information that American citizens submit to the IRS for taxation purposes is supposed to be confidential and protected at all times, the passing of The Taxpayer Browsing Protection Act of 1997 was very much needed. Such legislation is even more applicable as it relates to internet fraud, as the Taxpayer Browsing Protection Act of 1997 was passed during an era in which many American citizens were still filing their taxes through physical documents as opposed to via the internet. As such, the Taxpayer Browsing Protection Act of 1997 provides American citizens with protection as it pertains to the improper accessing of their taxpayer information.